Empowering Digital Banking for Small and Medium Enterprises

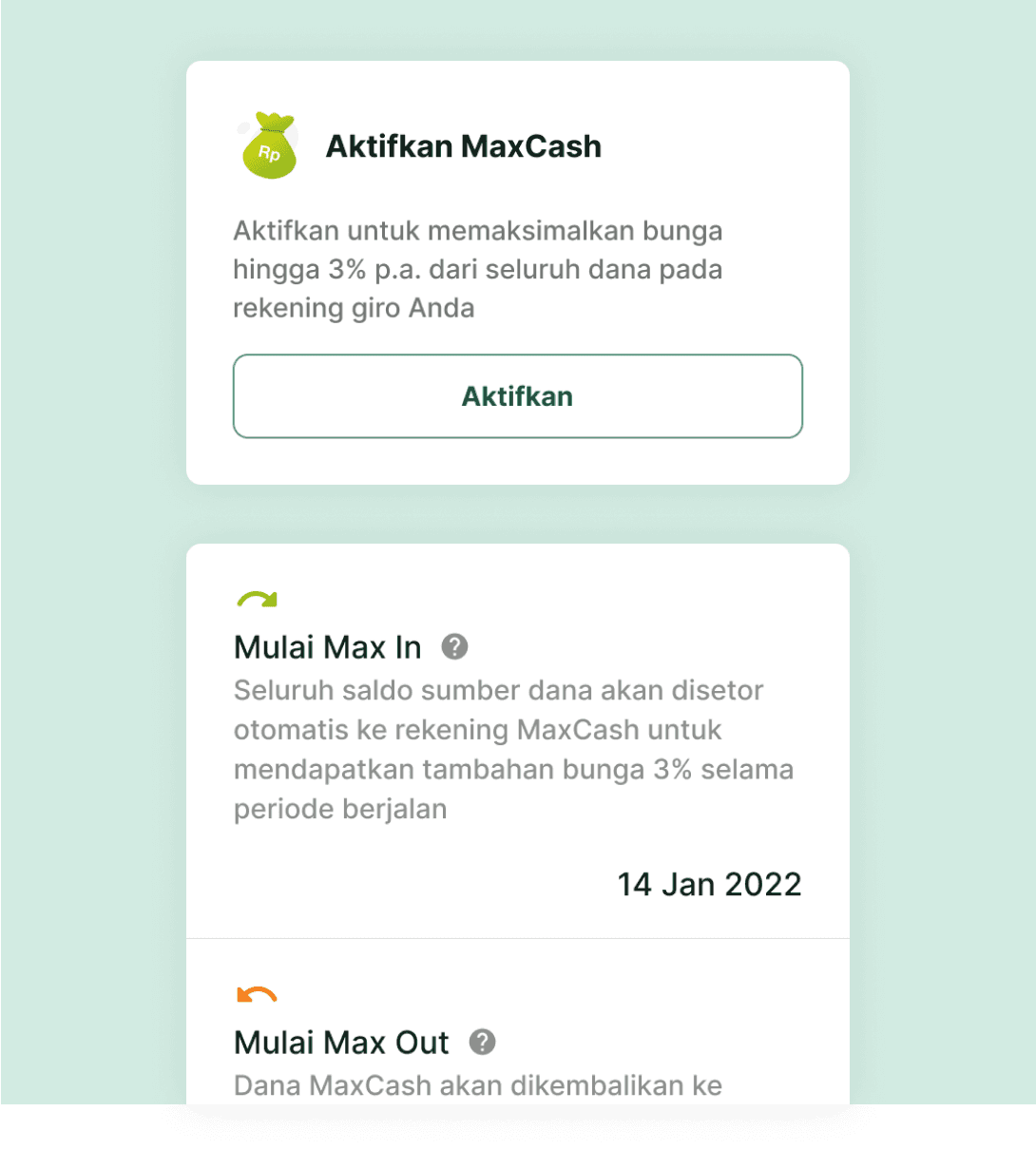

TouchBiz, a digital banking platform for Indonesian Small, Medium Enterprises (SMEs), offers personalized business solutions (Giro, Loans, Investments) based on current business needs. As a part of Bank BTPN in Indonesia, TouchBiz runs its services with a more personalized approach by tailoring each service accordingly to the customer's current business state to ensure that businesses leverage their working capital efficiently.

Balancing the ever-growing demands of business banking with the need for a lightning-fast, scalable platform to handle daily and intricate financial transactions

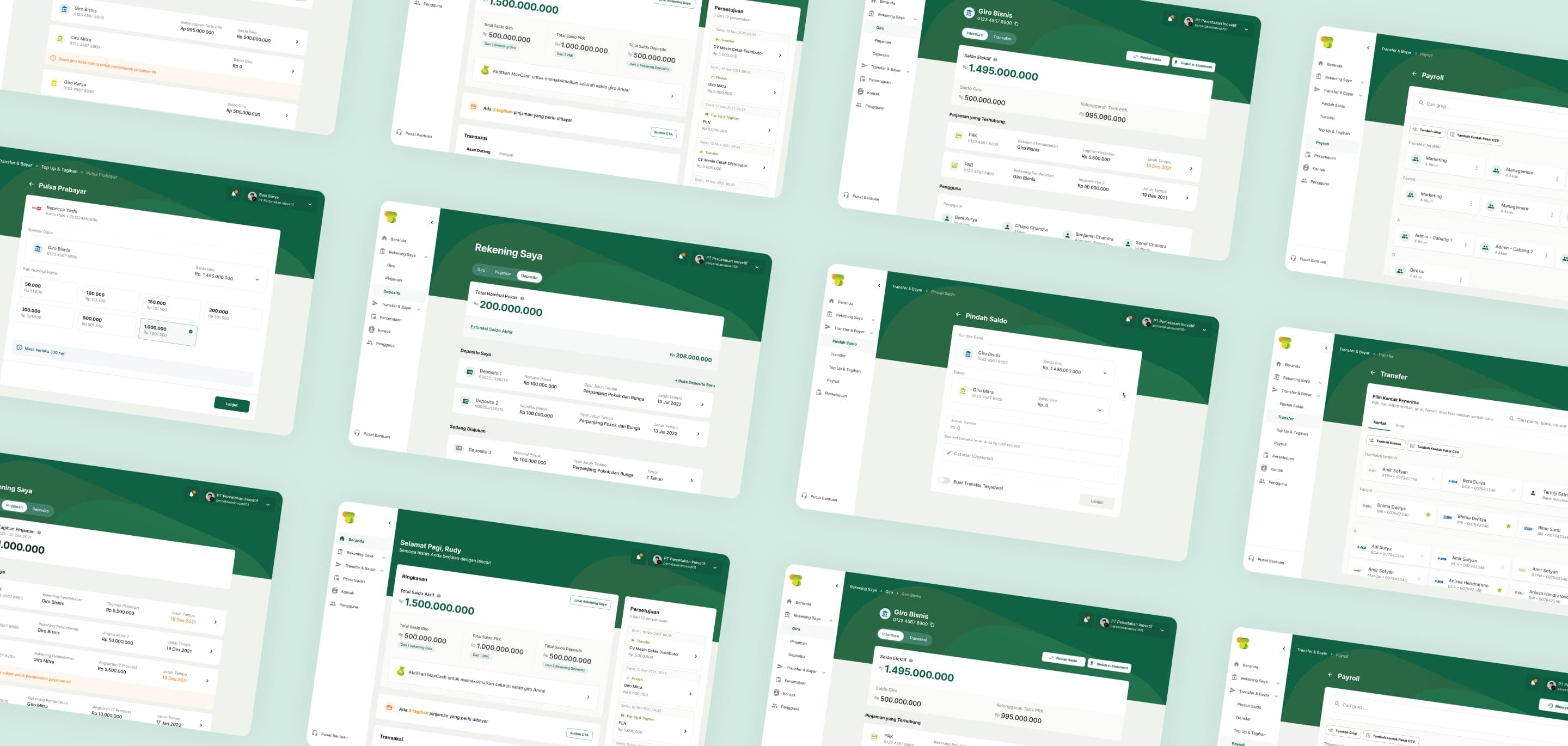

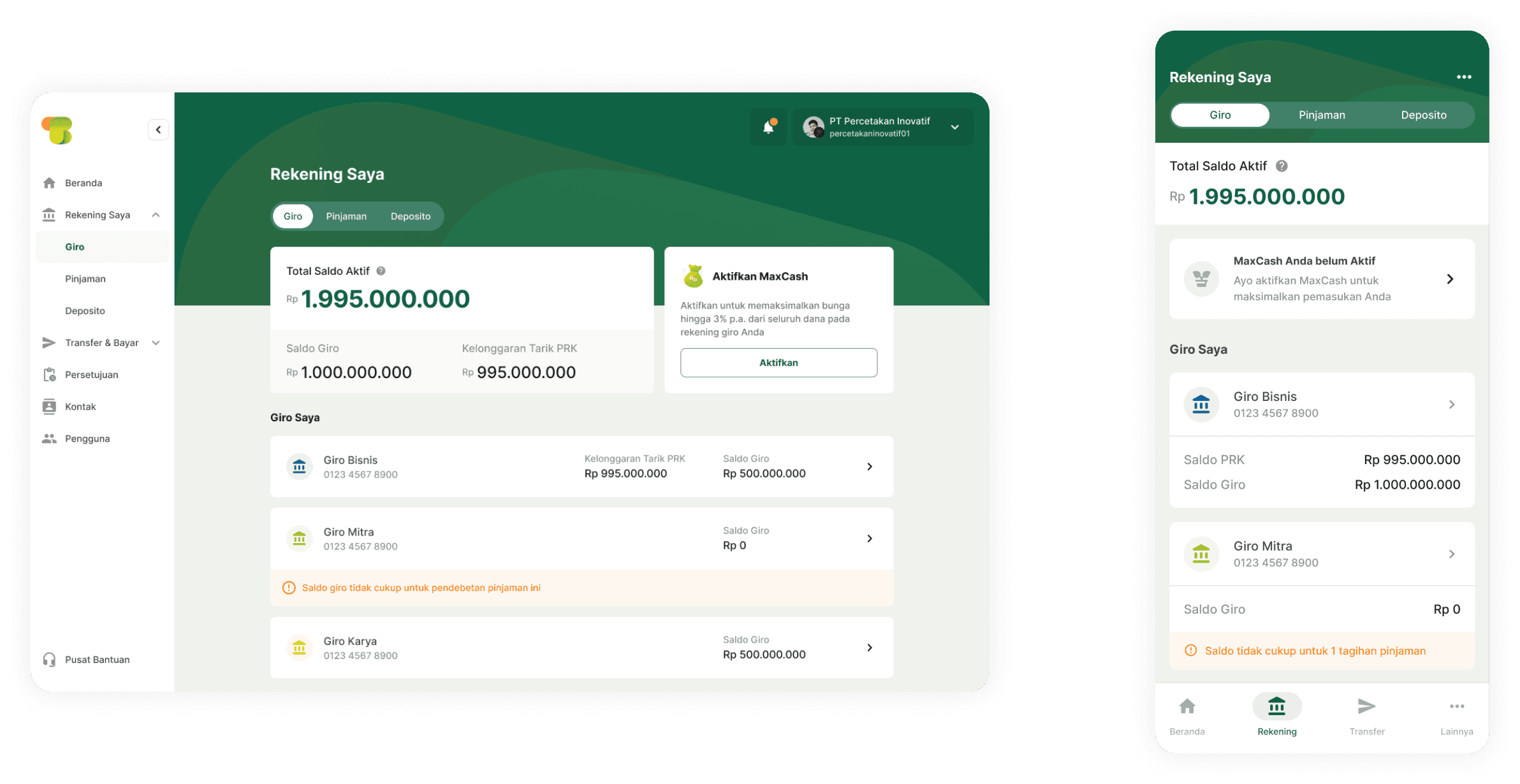

The platform is designated to have continuity from mobile app to web and vice versa. It also aims to work for individual and organizational customer profiles by applying a modular framework that is also scalable to anticipate more advanced features and functionality. These will keep the seamless experience present within the complexity of business banking services.

- User Experience Design

- User Interface Design

Category

- Designing for Holistic Experience

- Insurance & Financial Services

Press and Recognitions (1)

Tailored for the Best Business Banking Solution

To develop a business banking solution that caters to specific customer needs, we conducted a mini-discovery research. This involved:

- Competitive analysis: Reviewed existing business banking platforms to identify best practices and potential gaps in the market.

- Stakeholder interviews: Interviewed relationship managers to understand customer's demographics, financial health, business scale, behaviour, motivations, and expectations.

- Usability testing: Conducted usability tests with prototypes to evaluate user interactions and identify areas for improvement in future iterations.

This research will help us design a user-friendly and effective business banking solution that directly addresses the needs of our target audience.

Our Approach

Identify the limitations and opportunities of the existing platform to offer a better product structure and user experience.

Design a scalable and modular framework, such as; mapping flows and layouts based on different types of customer needs & behaviors.

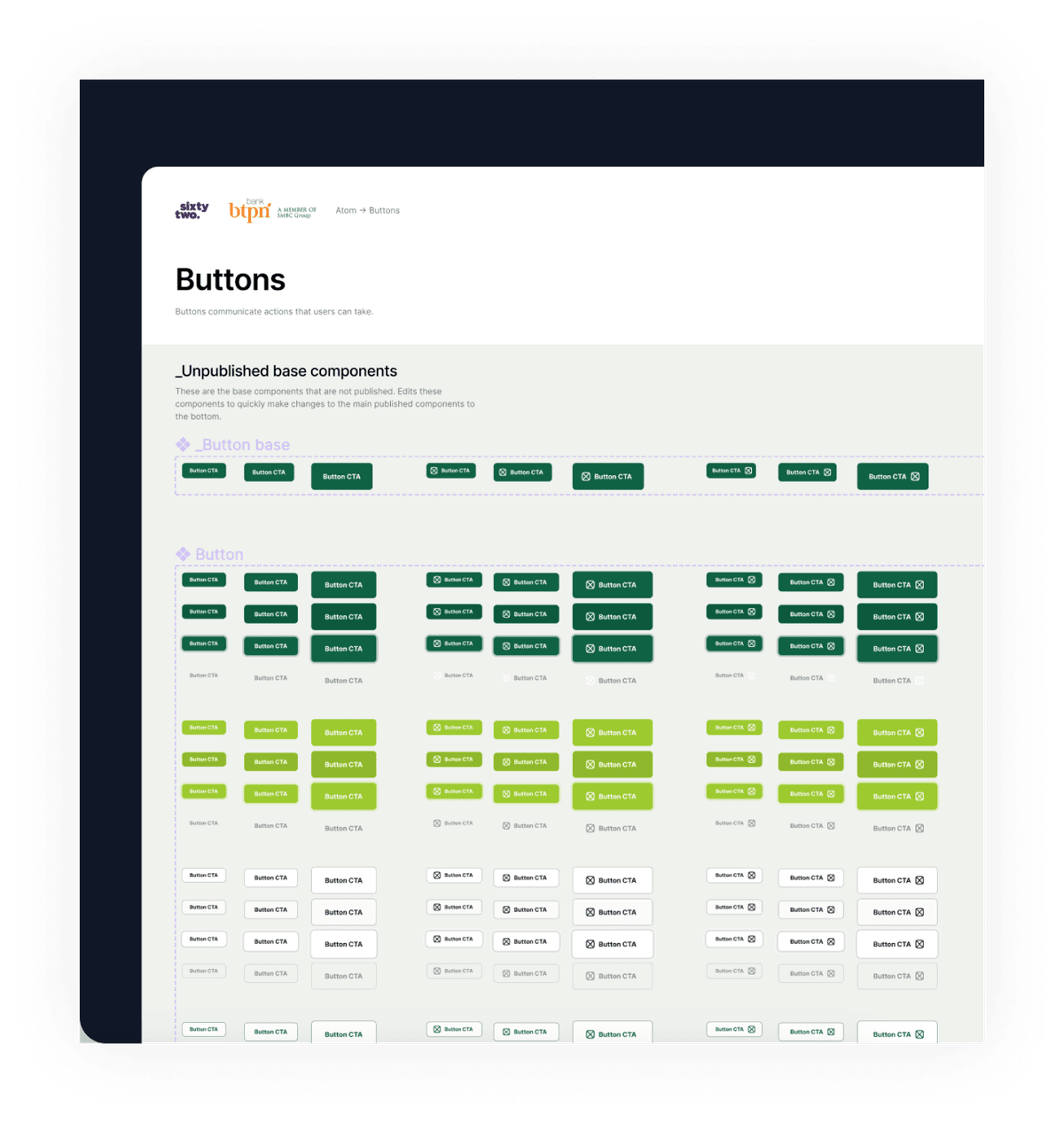

Redefining a new interface based on a defined framework and pushing a bit more with components efficiency, design system, and accessibility compliance.

To gain a comprehensive understanding of existing customer behavior, motivations, and expectations, we conducted a targeted discovery research initiative. This involved the identification and analysis of existing business banking platforms, complemented by stakeholder interviews. The customer segmentation employed for this research considered factors such as demographics, financial health, and business scale.

Our primary objective is to enhance the ability of business owners to fully leverage BTPN's business banking offerings through their digital platforms. During this process, one key insight emerged: business owners may not possess the highest level of technological or financial expertise. This can lead to confusion regarding banking terminology and a reluctance to adopt technology as a means to bridge this gap.

How Might We simplify scaling features for SME banking to ensure growth without introducing complexity?

A Modular and Streamlined User Experience for All

The new navigation system prioritizes user experience by allowing them to locate essential actions faster and more intuitively. This future-proof design ensures continued ease of use as we introduce new features without compromising the existing functionality.

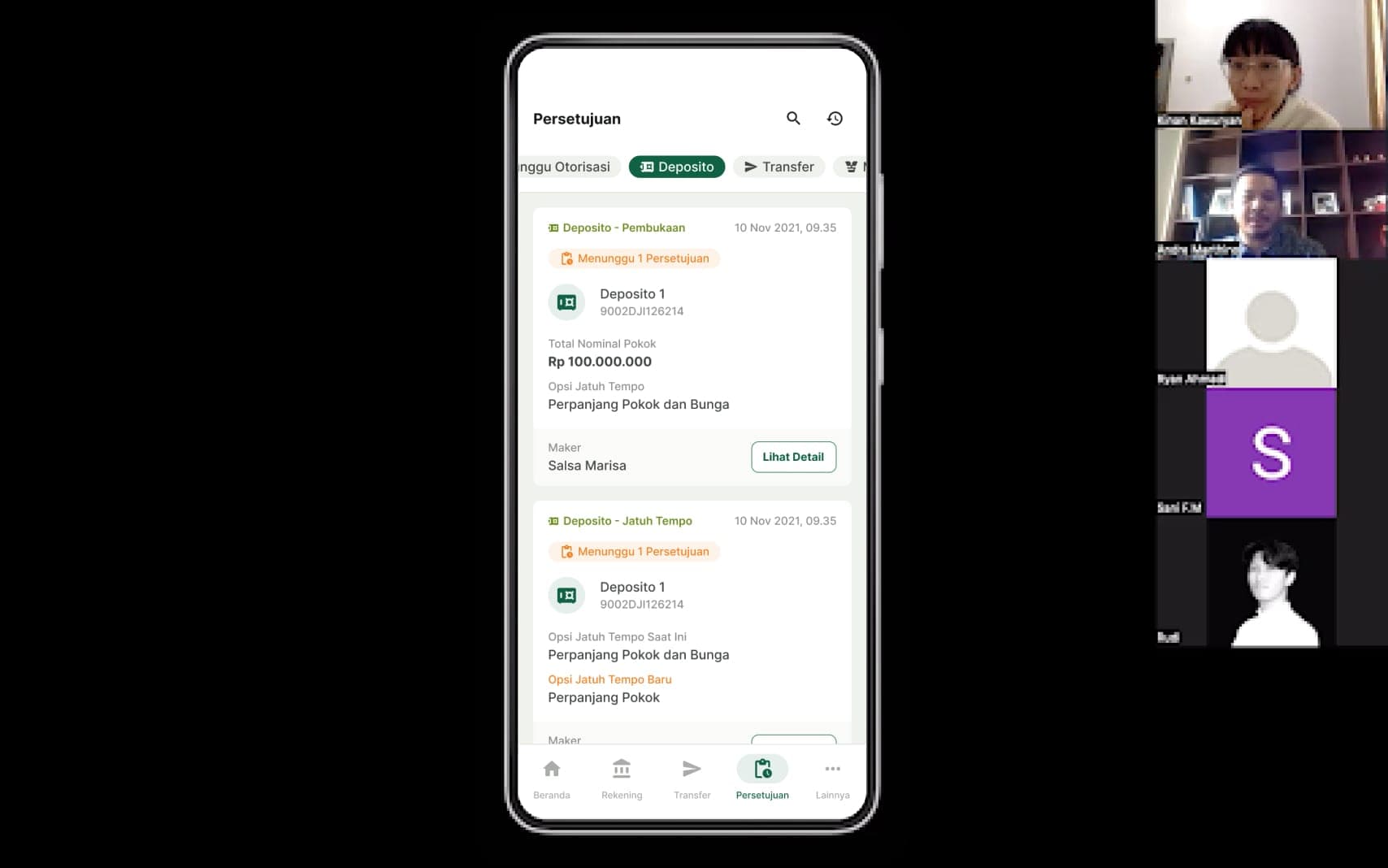

We understand the need for differentiated user experiences based on approval workflows. Our modular design approach tackles this challenge by enabling the seamless delivery of tailored content and functionalities for both individual and non-individual users. This ensures a frictionless experience, regardless of approval requirements.

Reducing Cognitive Load through Simplified Content Writing

We recognized the challenges small and medium enterprises (SMEs) face with complex business banking terminology. To bridge the gap in financial and technological literacy, we simplified TouchBiz' language in use. This means using clear, everyday terms instead of complex jargons, and providing concise explanations where needed. By reducing the cognitive load of understanding financial concepts, we empower SMEs to make informed decisions and navigate their banking experience with greater ease.

Achieving Product Scalability with a Comprehensive Design System

Sixty Two's foresight in creating a collaborative design system became a game-changer for TouchBiz. This meticulously documented system acts as a central hub for all design components, decisions, and patterns, ensuring consistency and efficiency as the project progresses. Furthermore, the design system streamlines the development process, allowing the team to move forward efficiently, saving valuable time and resources.

Let’s collaborate!

Whether you have a project you would like to chat about, looking to work with us, or want to get to know us.